CoinBase: Centralized or Decentralized? ₿

#2 CoinBase IPO'd this month. What does this mean for crypto, fiat, and what are the risks?

Being Human by Psaco

CoinBase: Centralized or Decentralized?

The other Saturday morning my girlfriend woke up and was making coffee while I did the usual routine of scrolling through my emails, and shaking my phone for free Bitcoin (referral link). When she came back she asked:

“Hey, what’s the price of CoinBase right now?”

Of course, it's a funny question, but at least I could have an answer for her if she had asked me how $BTC was doing that morning. As the finance and crypto community are well-aware, Crypto exchanges operate 7 days a week, 24 hours per day. The internet has no days off. Whereas CoinBase’s $COIN is the stock ticker of a company that’s publicly traded on the NASDAQ US stock exchange. Thus, the price of CoinBase would only really change when the stock markets are open (Monday - Friday, 9:30am - 4 pm, except statutory holidays!).

CoinBase acts as a centralized hub for buying and selling all kinds of cryptocurrencies. Given how hot crypto is with the staggering inflation of fiat currencies, and how hot CoinBases’ growth numbers are looking, it’s worth asking if CoinBase could be considered a “centralized” or “decentralized” entity, and what that might mean for the future of cryptocurrencies, and the future of CoinBase.

At the time of writing:

By CoinBase overcoming regulatory hurdles to go public, along with the above indicators of mainstream adoption, it legitimizes crypto as part of a portfolio or general investment strategy for many retail and institutional investors.

Some are extremely bullish on CoinBase as a company, touting its first mover advantage, large group of active users, high year-over-year growth, and the fact that it acts as a user-friendly, all-in-one (buy/sell/hold) solution that reduces friction for the average user wanting to get into the crypto space. Seems like a win for crypto, but is it really?

Many crypto maximalists believe that investing fiat money as shares representing ownership in a centralized exchange where someone else holds your coins for you, is antithetical to the core principles that crypto introduces to the world - namely, the power to own your own money, and be your own bank.

“Not your keys, not your coins” - Andreas Antonopoulos

So what if I buy decentralized coins (BTC) from a centralized crypto exchange (CoinBase) that’s listed as a public company, valued on a centralized and regulated fiat exchange (Nasdaq) located within a physical country’s jurisdiction (USA)?

Seems like a loaded question. What are the risks?

Risk 1 - Keeping your coins on CoinBase

At any point in time, CoinBase (and any crypto exchange that holds your coins) has the ability to shut you out of your account, and from accessing your funds. Ironically the opposite of what the decentralized finance movement is all about. This means you as a user, agree to have your transactions and holdings handled via CoinBase. However, you also give them the power to take away your coins from you, at any point in time, for any reason, and you can do nothing about it. Take your coins off centralized exchanges if you can. Now. Yesterday. If you can’t, you can either liquidate, HODL, or ask your holder about transfer options. Make sure your future coin purchases and transactions are done through your own wallet. It can help to research some hardware wallets, and learn how to back them up properly. Ensuring you have the keys to your own coins means that the future of $COIN as a company, isn’t something you have to worry about as a crypto asset holder.

Risk 2 - CoinBase is correlated with Crypto Prices

As wild swings appear in the price of major crypto assets, the price of CoinBase in the short-term may also swing (some degree of shared variance in price movement). This is evident already in that the weeks leading up to CoinBase’s IPO date, the price of cryptocurrencies (especially BTC and ETH) shot up vertically to new all-time highs. This means that if the valuation of cryptocurrencies go down, $COIN may also drop. Though, $COIN’s business model depends largely on transaction fees when users buy and sell their coins through the exchange. Thus, they could still be making good money when there is market activity, and coin valuations go in either direction.

Risk 3 - Existential hacks to CoinBase

Some unprecedented shut-down or hack of CoinBase could mean that the stock falls drastically, and many or all of CoinBase users can risk losing their crypto assets. This would likely be a worst-case scenario for the exchange and its users, and would permanently taint the reputation of CoinBase as a secure method of buying, selling, and holding crypto assets. Additionally, it’ll leave a sour taste in the mouths of many crypto enthusiasts, who might unfortunately shy away from crypto in the future because they saw their money evaporate right in front of their own eyes, and could do nothing about it because they didn’t have ownership over their own digital keys to their wallets.

Risk 4 - More wide-scale adoption of DeFi protocols

As the less-popular, more decentralized versions of CoinBase emerge, they will also become more secure and accessible to the average user. If people become comfortable securing their own private keys, and the user interface and experience of these decentralized protocols improves, then these decentralized exchanges and services (like UniSwap, MetaMask) would directly compete with CoinBase users, and have the security of owning their own coins.

Risk 5 - Regulators

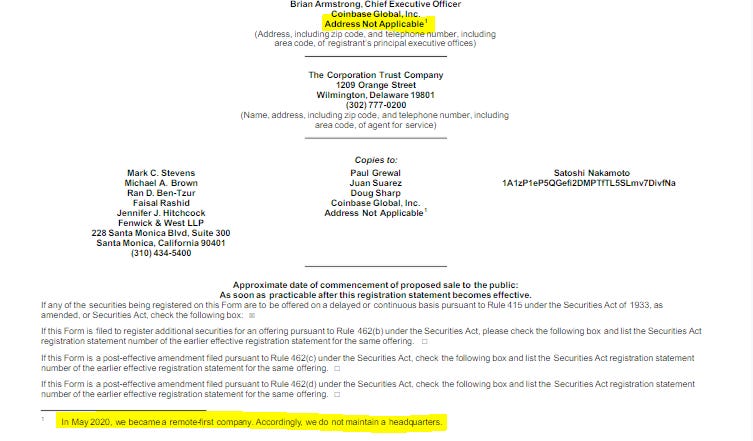

On its public listing, CoinBase claims to have no real physical address, as it considers itself a remote-first company. However, given that it is still a public company trading on an American stock exchange, this can be misleading (CoinBase’s legal headquarters are apparently in San Francisco, California). However, if the "no keys, no coins" idea holds here, CoinBase should have a listing for some physical address for accountability’s sake. Else, they should give the user the option to have full access to their public and private keys for the coins they store on your behalf.

Until then, should CoinBase really consider themselves “location-less”?

Regulators can swoop in and change rules, being more strict about requiring a physical address for things like complaints, procedural issues, sending paperwork (for the fewer and fewer things that we need to submit via mail), or for when someone just needs to get a hold of someone at the company, at a physical address.

Regulators can also come in and require income reporting (linking your keys with your identity, tracking incoming and outgoing payments), all of which again stray away from the decentralized, anonymous, institution-free nature of cryptocurrencies and their philosophy.

If regulators get too tough, or their proposed regulations attempt to break some fundamental ideas of cryptocurrencies (like the right to privacy), then there may be a greater push towards more adoption of decentralized, over centralized crypto entities, ultimately hurting CoinBase’s bottom line (but helping decentralized exchanges and holding methods like UniSwap and Trezor Wallets). Regulators could badly hurt CoinBase, but won’t be able to stop the crypto revolution.

Risk 6 - Fiat destroys itself

It’s funny to think that the CoinBase IPO has made it the largest bridge between the decentralized internet, and the centralized financial institutions.

You can now buy stock in a company ($COIN) that is valued in fiat money, based on its trade activity and userbase, but who also holds users’ coins ($BTC, $ETH). These coins are valued based on the general mass belief, utility, and adoption of these coins. As $COIN’s user base goes up, crypto valuations themselves go up, which further fuel $COIN’s user activity as people buy on the upswing, increasing $COIN’s fiat valuation further, and so on. It becomes an uneasy bull cycle, where it's almost like crypto and $COIN grow together, and there’s a background war happening between fiat and crypto. Interestingly, this war is being fought through a centralized entity that has no physical address, yet trades on a heavily regulated stock exchange in the USA, yet benefits immensely from the network effect of cryptocurrencies, yet can still make money on trading activity when crypto prices dip. $COIN is definitely a very uniquely positioned company and business model that shouldn’t be ignored by the traditional Wall-Street suits, nor the retail investor.

You’re ultimately buying the CoinBase stock with the belief that this company will have outsized returns (at least greater than an index fund, ~9%/yr.), at growth rates that surpass inflation (~2-3%/yr.). Still, you can’t get away from the fact that you’re buying the stock in.. good ol’ US Dollars.

The problems with spending USD to buy stock in a crypto company, is that hardcore crypto maximalists believe that the USD (and all fiat-based, centralized currencies) will eventually print themselves out of relevance and existence. Inflation is sky-rocketing from excessive monetary stimulus due to COVID-relief money. Government corruption inevitably hurts a country’s economy and their currency. Long-term interest rates being at historic lows suggests a weak economic outlook. These factors combined, simply means that governments can’t keep printing money forever without some massive consequences for the underlying currencies, and the respective countries.

So why wouldn’t you just convert your investable US Dollars into Bitcoin, Ethereum, or any number of other emerging cryptocurrencies today? Why would you use your inflationary fiat money to buy shares of a centralized entity that facilitates “decentralized” transactions, instead of just converting that fiat money into the decentralized currencies themselves, really owning them, and enjoying multiplicative gains outweighing $COIN over the long run?

tl;dr:

CoinBase is arguably the biggest, centralized application in the decentralized space

CoinBase is ultimately helpful for the crypto world, as it exposes more people to the ideas and vision of the crypto community

CoinBase faces many unknown threats, given that it’s a pioneer in the space. Still, believers in the stock may yield large gains and be a part of the crypto bull-run, realizing their gains in fiat currency, in the traditional financial world

CoinBase looks overvalued to many and undervalued to some. I’m personally:

Short-term: Neutral-Bullish (~6 months)

Long-term: Very Bullish (~1-5+ years)

Looong-term: Neutral-Bearish (~20+ years) - stagflation, corruption, and general post-COVID global economic recovery looks worse for some countries than others. Though it’s difficult to say what will happen, since most of the world is still trying to get through the ongoing pandemic. However, it’s possible that the next few decades lead to some destroyed fiat-run currencies, and countries. If the US Dollar gets destroyed or replaced, does it really matter if $COIN goes 100x in the next 20 years?

$COIN might be a nice stock to own in a traditional stock market portfolio, but decentralized will ultimately beat centralized. Will investing $10,000 in $COIN do better than buying $10,000 of $BTC? Probably not.

Like what you just read? You can subscribe to the newsletter if you haven’t already, and you’ll receive the next one straight to your inbox.